Join The Priority Waiting List

Build wealth intelligently.

In any property cycle.

Supercharge your property portfolio and SMSF with property development.

Minimum $10,000 investment.

Our technology and investment model is your competitive advantage.

Watch how these investors paid 21.7% below bank valuation for a brand new property in a top location. Rents soared 10% during construction. Investors earned 57% return on cash invested. Vacancy rates less than 1% with 85% of residents owner-occupiers. Properties purchased in SMSF with $93,000 instant equity for mortgage deposit after investors retrieved entire cash invested.

Column 1

Column 2

The stats don't lie. Most investors have got it wrong.

Traditional property investment is inefficient and costly and most investors rely on uncertain market forces to build wealth. Our model gives investors certainty with access to manufactured capital growth when retaining a property or a share of the development returns if investing cash only.

It's a smarter way to invest.

Investors only own one property

Investors paying money in after rent

Investors own six or more properties

Source: Corelogic | ATO

Buy under market value.

Get more properties sooner.

Sophisticated investors never pay retail prices. They prefer to invest at cost and share in the development profits whether they retain a property on completion of the project or not.

Get 30% returns in central location

Some recent developments

$7,540,000 funds raised for 8 projects

Annualised Return | 57% |

Discount on completion | 21.7% |

Stage | Completed |

Annualised Return | 50% |

Discount on completion | 22% |

Stage | DA obtained |

Annualised Return | 54% |

Discount on completion | 18% |

Stage | Nearing completion |

Annualised Return | 55% |

Discount on completion | 23% |

Stage | Nearing completion |

Some published articles and columns.

Michael Fuller, founder of Hotspotcentral has written extensively about the armchair co-developmemt strategy. His research techniques and proprietary investment algorithms have been used by thousands of investors and industry experts alike.

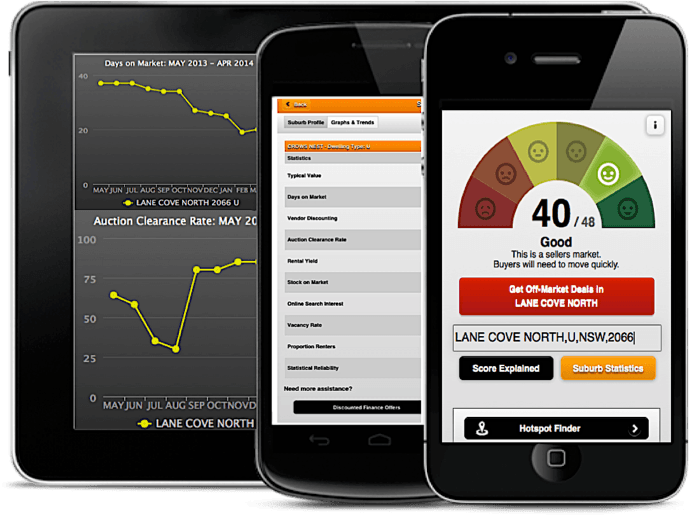

DSR BoomScore™ one of our proprietary in-house research tools. Pick investment locations with 97% scientific accuracy.*

Boomtown grabs millions of data points from multiple public sources and generates 8 leading indicators of supply and demand

Each indicator is compared to known benchmarks to calculate the ratio of demand to supply for units and houses in 15,000 suburbs. That's 30,000 micro property markets measured in seconds.

The DSR BoomScore™generated rates each suburb (houses and units) from 0 to 48:

- 48 suggests a suburb with a high probability of imminent capital growth

- 24 is a suburb in theoretical balance (supply meets demand)

- 0 is a suburb with a high chance of price decline due to over supply relative to demand

Hotspotcentral's Top 50 suburbs for 2014 selected using the DSR BoomScore™ averaged 40.97% against a market average of 12%. That's a staggering 26% difference. See More

*based on an independent audit by the Data Group.

TRY BOOMTOWN

Join over 13,970 investors who use Boomtown and our insights to pick their own investment hotspots with scientific accuracy.

Boomtown is a web app which works on all browsers both mobile and desktop: boomapp.com.au

"There;s now a quick and easy way to choose boom suburbs" Read More