As published in Your Investment Property Magazine, June 2012

Written by Hotspotcentral.com.au’s research analyst.

Just because you’re on a minimum wage doesn’t mean you can’t invest in property. Hotspotcentral.com.au’s research analyst shows you how to do it safely.

There are a lot of numbers you need to consider carefully if you plan to invest in property when money is tight.

Firstly, there are numbers related to the purchase price you can afford. This includes considering the deposit, stamp duty, legal fees, pest/building inspections and a host of other things and usually comes down to how much savings or equity you have.

Then there are numbers based on projects you might intend on doing such as a renovation, extension, subdivision or development. Finally, there are numbers related to holding the property. This includes things like servicing the mortgage, rental income, management fees, repairs and depreciation.

On top of all this, you need to allow a safe margin for error: renovation costs may blow out, interest rates may increase, tenants may fall behind on rent or the hot water system could die.

It all sounds a little scary to the first-time investor and even worse if you’re on a tight budget. But there are some numbers you can look at which will make the investment much more likely to be profitable and less risky in many of these aspects. They relate to the nature of the market you’re buying into.

THE NEED FOR CAPITAL GROWTH

A small amount of capital growth soon after purchasing a property can place a safety net under your investment. So, if you were to lose your job, for example, and could no longer make mortgage payments, the property could then be sold for more than the costs of buying and selling, due to the capital growth. You’d effectively get out of the deal with an excellent learning experience and hopefully no financial loss.

To ensure you have this kind of safety net, you should find a market with potential or immediate capital growth and one that has just recently started showing signs of capital growth. A large infrastructure project that is still in the planning stages should be avoided. Even one nearing completion may be too risky. Wait until you see signs of growth that confirm that the project is affecting the market in a positive way.

If you get a decent amount of capital growth, a poorly managed renovation project can be turned into a great success. Good capital growth covers a multitude of mistakes so it’s important to not just perform due diligence on your budget, but on your location too.

A decent demand to supply ratio will also underpin your property if you need to sell quickly. Ideally, you want to sell quickly into a market that has a very short ‘days on market’ figure (DOM).

But it’s not just capital growth and low risk that can underpin your investment. The cash flow you’ll receive is dependent on the nature of the market you’re buying into more so than the nature of the property itself. For starters, you definitely don’t want to buy into a market with a high vacancy rate. And obviously you want a high yield, too.

A low proportion of renters to owner-occupiers can also be important since it means there’s less competition amongst landlords for the tenants that are available.

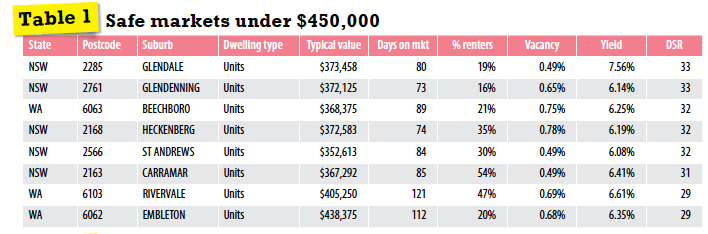

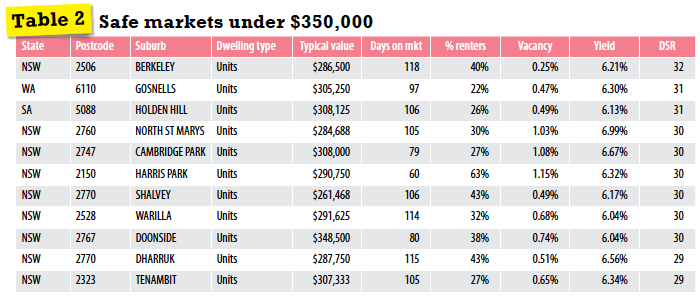

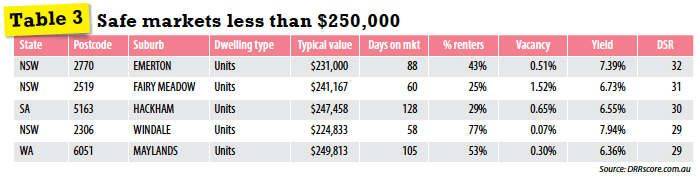

I’ve done some research and pulled out data from our database for March 2012 (DSRScore.com.au). I looked for markets with solid demand to supply characteristics to reduce risk and increase the chances of immediate capital growth.

Given that one investor’s idea of ‘cheap’ can be twice as expensive as another’s, I’ve created three tables: one of markets with typical values under $450,000, another with typical values under $350,000 and the third with typical values under $250,000.

These are just starting lists for further research. You should not base your investment decision purely on the data in these tables. Investigate each one thoroughly before making any sort of commitment.

SOME MORE TIPS

I have a few other tips for those investors with small or non-existent portfolios and tight budgets. I’ve learnt that there is a relationship between cutting costs and increasing risk:

1. Fixed versus variable interest

In the long run, more often than not, it works out cheaper having a variable loan over a fixed one. You also get greater flexibility. That’s why I have variable rates on all my mortgages. But if cash flow is tight, don’t go variable – go fixed for at least the first year. If things are tight, you really can’t afford to have anything go wrong. This is one very easy way to eliminate one of the great cash flow unknowns – interest rate changes.

Ideally, have about 90% of the mortgage fixed and 10% variable. This will allow you to pay down part of the mortgage if you happen upon some extra cash. Having a redraw or offset facility so you can get that extra cash back in times of trouble is also advisable.

2. Insurance

Get building and landlord insurance and don’t skimp by trying to get a cheaper premium. Your focus should not be on cutting costs, but on getting the best cover. One day, when you have a double-digit portfolio you can start cutting costs.

3. Property management

Thoroughly research property managers servicing the area and don’t consider their fee, instead consider their service. Then go for the best service and experience, not the best rates. The best property manager I’ve ever had is still the most expensive I’ve ever had and I’d gladly pay the same rate to all my managers if they could deliver the same service. There’s no such thing as a problem tenant when you have an excellent property manager in charge.

4. Setting the rent

Don’t set the rent too high waiting to land a golden goose. Be reasonable and, if anything, cut the advertised rent to ensure you get a good range of tenants applying so you can pick the most reliable.

5. Vacancy

Don’t accept a tenant if their application doesn’t look sound. This can be a tricky waiting game. Vacancy hurts cash flow, but a bad tenant will kill it entirely. Budget for an extended vacancy upfront so you can be choosey about your first tenant.

6. Depreciation

Be sure to organise a quantity surveyor to produce a depreciation schedule. Although an accountant will do it from their desktop and cheaply too, a quantity surveyor will find a lot more depreciable items. Then take the schedule to your accountant and ask for a tax variation so that less tax is taken from your salary immediately rather than waiting till tax time and then getting a big refund.

Everything I’ve mentioned above costs more in the short term, but it pays more in the long term. And remember, property is a long-term investment.

Your Investment Property Magazine

June 2012